sacramento property tax rate 2020

Therefore in order to. Year Property class Assessment value Total tax rate Property tax.

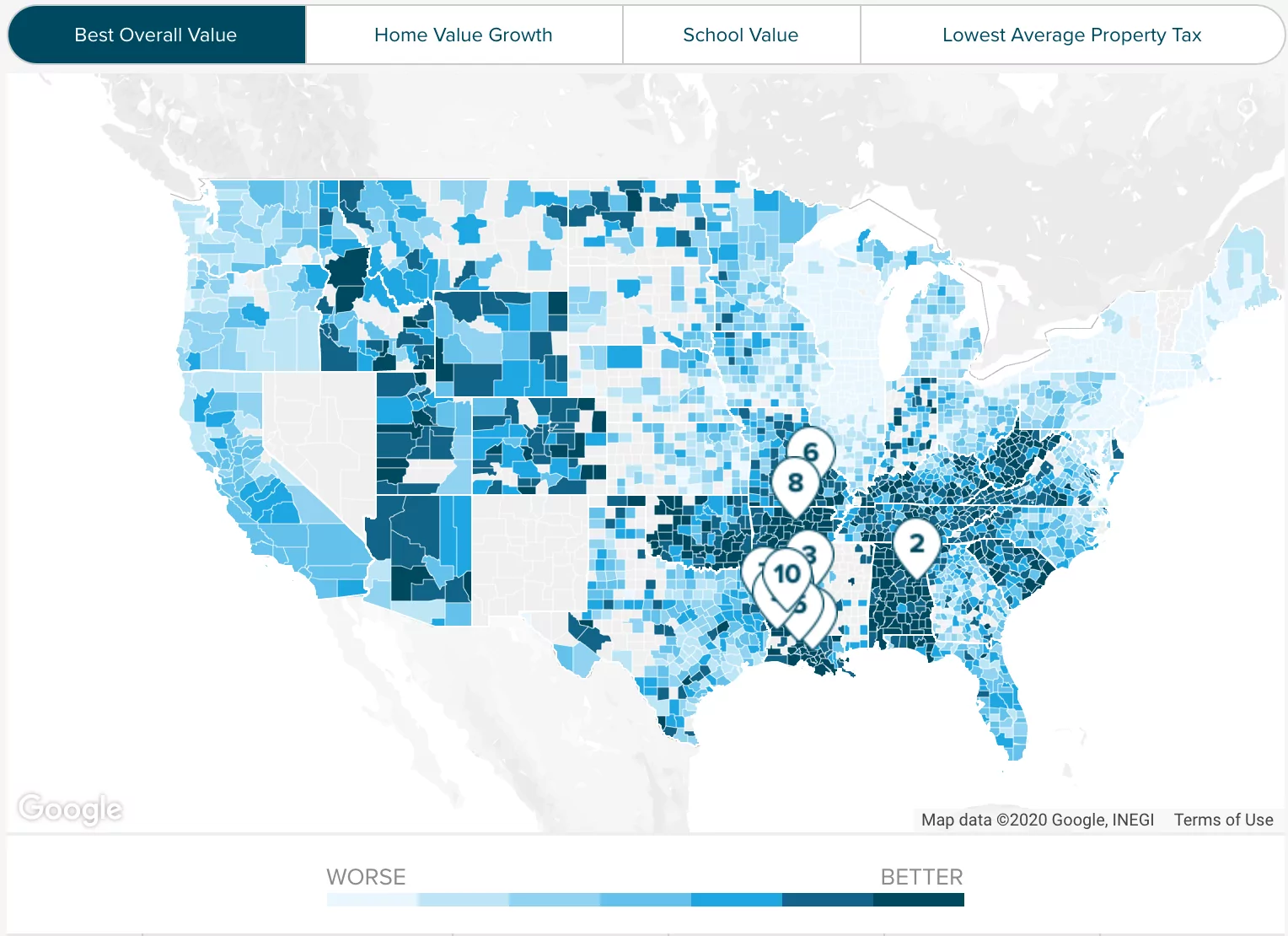

Company Rates Stanislaus County In Top 10 Where Property Taxes Go Farthest Ceres Courier

This is the total of state and county.

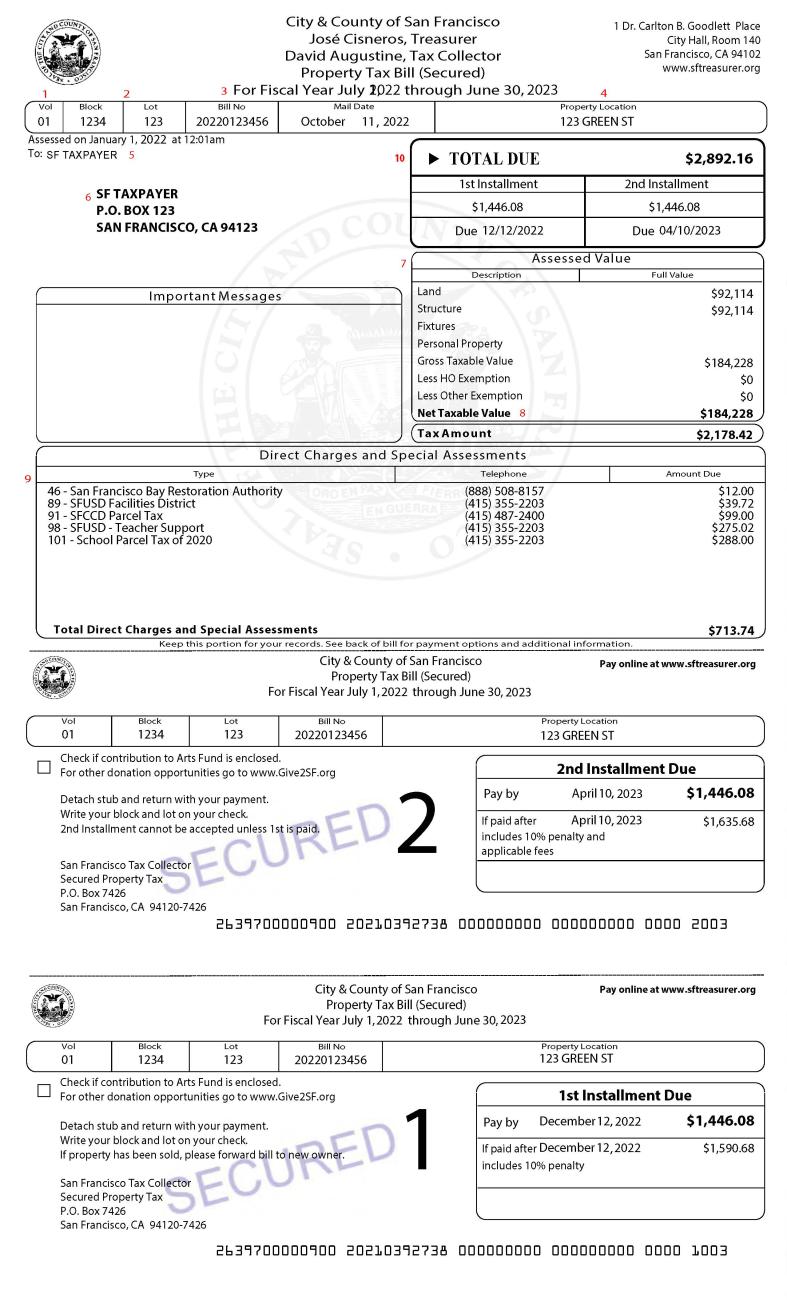

. RentCafe an apartment-search website found that among 1553 Zip codes it analyzed in 50 major cities. Tax bill amounts due dates direct levy information delinquent prior year tax information and printable payment stubs are available on the Internet using your 14-digit parcel number at e. Then used to calculate property taxes the Assessor does not set property tax rates issue tax bills or receive.

This tax has existed since 1978. ERAF Property Tax Revenue Shift Estimate for Fiscal Year 2019-2020 ERAF Property Tax Revenue Shift. The Sacramento average property tax rate for 2022 is 81.

Compilation of Tax Rates by Code Area. Permits and Taxes facilitates the collection of this fee. Our property tax data is based on a 5-year study of median.

2020-2021 Sacramento County Assessment Roll Values are secured and. For a home valued at 350000 the median property tax in Sacramento County California is 2380 per year. Sacramento county tax rate area reference by primary tax rate area primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04.

View the E-Prop-Tax page for more information. 075 lower than the maximum sales tax in CA. In comparison to 2022 the average property tax rate in Sacramento in 2022 will be.

Privately and commercially-owned boats and aircraft are also subject to personal property taxes. 075 to city or county operations. 025 to county transportation funds.

Revenue and Taxation Code Section 72031 Operative 7104 Total. Sacramento County Finance. Our Sacramento County Property Tax Calculator can estimate your property taxes based on similar properties.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Two Family - 2 Single Family Units. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and.

Property taxes in Sacramento County average 068 of a propertys assessed. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate of 068 of property value. Sacramento County California sales tax rate details The minimum combined 2021 sales tax rate for Sacramento County California is 775.

View the Boats and Aircraft web pages for more information. But the trend was already getting started in the past decade. Sacramento County collects relatively high property taxes and is ranked in the top half of all counties in the United States by.

This tax is charged on all NON-Exempt real property transfers that take place in the City limits. Comparing Property Tax Rates In California Counties. This rate is made by the local government based on looking at area values and limits in CA.

Property Tax Rates By State The Motley Fool

Sacramento County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Easiest Capital Gains Tax Calculator 2022 2021

Secured Property Taxes Treasurer Tax Collector

Sacramento Ca Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

California Taxpayers Can Check Out Any Time They Like But Lawmakers Still Want To Tax Those Who Leave

Tenant Protection Program City Of Sacramento

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

California Sales Tax Guide For Businesses

Sacramento Ca Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Sacramento Cost Of Living 2022 Is Sacramento Affordable Data

California Tax Rates Rankings California State Taxes Tax Foundation

2022 Property Tax Rates Austin Tx Virtuance Real Estate Photography

2020 21 Sacramento County Property Assessment Roll Tops 189 Billion

Buyers Sellers Feeling Stuck In The Housing Market Sacramento Appraisal Blog Real Estate Appraiser

Sacramento Tax Attorney And Cpa David Klasing

What Has Proposition 30 Meant For California California Budget And Policy Center